Saving for Your Child's College Education

Writer

Writer

www.bestcolleges.com is an advertising-supported site. Featured or trusted partner programs and all school search, finder, or match results are for schools that compensate us. This compensation does not influence our school rankings, resource guides, or other editorially-independent information published on this site.

Turn Your Dreams Into Reality

Take our quiz and we'll do the homework for you! Compare your school matches and apply to your top choice today.

Saving for Your Child's College Education

Perhaps the most dreaded aspect of getting a college education is the cost. This is understandable given the enormity of the student debt crisis in the United States. Over 44 million borrowers owe a total of $1.5 trillion in student loans, leading some political leaders to propose sweeping changes that cancel all student debt and make public colleges tuition-free.

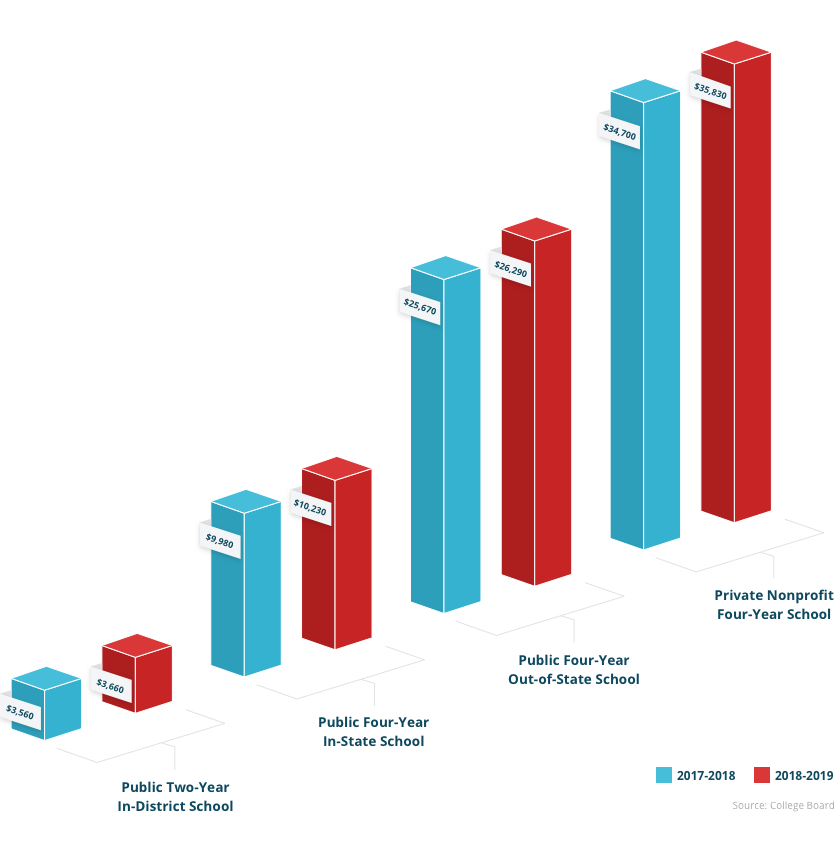

According to the College Board, the average annual cost of in-state tuition at a public four-year college reached over $10,200 in 2019. The average student debt reached $28,650, according to the Institute for College Access and Success.

For many families, college costs don't end with tuition; room and board can come with its own hefty price tag. The College Board reports that in the 2018-19 school year, average room and board ranged from $3,500 for public, in-district two-year schools to $34,700 for private, nonprofit four-year institutions. The exact cost will depend on the student's living situation (e.g., residence hall vs. off-campus housing) and the cost of living where the school is located.

As costs increase, parents have become more realistic about how much of their children's education they're able to cover. According to a 2018 Fidelity College Savings Indicator survey, only 49% of parents feel it is their responsibility to pay their child's college tuition in full, down from 56% in 2016.

Parents who do decide to help financially will likely find themselves asking questions about the best ways to contribute, such as: "When should I start saving?" "How much should I save?" and "Should I take out a loan?" In this section, we'll try to answer some of these questions and provide effective saving strategies for college.

How Much Should Parents Save, and When Should They Start?

Despite the widespread tendency to put off savings, most financial experts agree that saving earlier is better. Jill Rayner, director of financial and veteran aid at the University of North Georgia, recommends a savings account that the whole family can contribute to: "Each month I automatically have a payroll deduction made into each account. I also put extra funds in their college savings account for their birthday and for special holidays."

Even if you can't put aside money right now, you should start by determining the projected cost of your child's education. One easy way to do this is to check college websites, which usually have pages detailing the cost of attendance.

If you are in the early stages of planning and are unsure how to estimate costs, factors to consider include the length of time before your child starts college, whether prospective schools are two- or four-year institutions, and whether colleges are in-state or out-of-state. Another variable to take into account is that costs increase year to year, so tuition for 2020 is likely to be slightly higher than tuition in 2019.

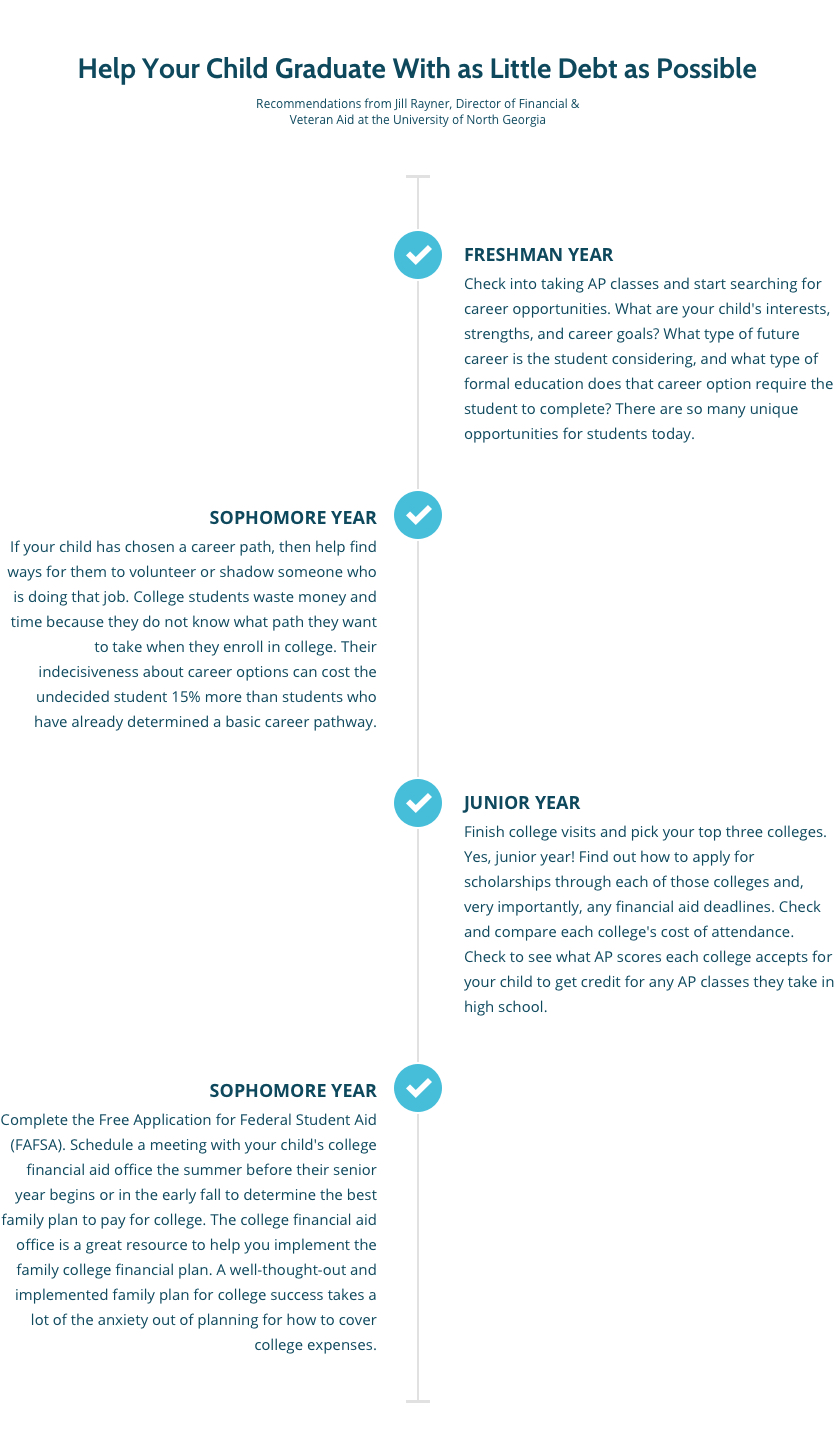

Below, Rayner outlines some academic and financial steps that can be taken while your child is still in high school. Rayner has worked in financial aid for over 25 years and wants every student to graduate college with as little debt as possible.

In addition, Rayner points out that many states offer college savings plans for parents to save for educational expenses. Check with your state's education department to determine the types of benefits available, how to start an account, and how to use the account to pay for college expenses once your child is enrolled.

College Savings Plans

If you have started a college savings fund, you deserve some credit. Giving your kids a leg up today can pay dividends in the future, alleviating student stressors such as working full time while in school or choosing careers that offset the cost of college. This may give you and your child peace of mind even if it creates financial stress in the short term.

There are many ways to save money for a college education. Our College Prep Survey aimed to determine the types of savings funds preferred by parents. Responses revealed that the following strategies are most common:

Below, you can find a breakdown of some of these savings plans explaining how they work and the pros and cons of each.

College Savings Plans Explained

529 Plan

Sponsored by individual states, 529 plans are not taxed federally when used to pay for qualified education expenses. Most states also offer tax benefits. There are two types of 529 plans: prepaid tuition plans and education savings plans. Eligible colleges must be accredited and included on the U.S. Federal Student Aid Code List. More information on 529 plans is available from the U.S. Securities and Exchange Commission and the Internal Revenue Service (IRS).

Pros

- You can shop around for different states' 529 plans to maximize savings

- No federal taxes on earnings

- Usually no state taxes on earnings

Cons

- Significant upfront costs

- Minimum contribution requirements (in some cases)

- May impact eligibility for need-based aid

- Limited investment options

Coverdell Education Savings Account (ESA)

A Coverdell ESA is a trust or custodial account used to pay for qualified education expenses on behalf of a designated beneficiary. Earnings and withdrawals from these accounts are tax-free on a federal level, but contributions are not tax deductible. The fund must be disbursed before the beneficiary turns 30. More information on Coverdell ESAs is available from the Internal Revenue Service (IRS).

Pros

- No federal taxes on earnings or withdrawals

- More numerous investment options than under 529 plans

Cons

- Age limits for beneficiaries

- Yearly, income-based contribution limits

Uniform Transfer to Minors Act (UTMA) or Uniform Gift to Minors Act (UGMA) Accounts

The UTMA allows minors to receive gifts, such as money and property, without a guardian or trustee. The person giving the gift or an appointed custodian manages the account until the beneficiary comes of age, usually between ages 18 and 21. Disbursement of a UTMA account is tax-exempt up to a specified value.

The UGMA is similar, but a UGMA account is limited to purely financial products such as cash, bonds, stocks, mutual funds, and other securitized instruments such as insurance policies. A UTMA account, by comparison, can include any kind of property, including real estate. More information on these accounts is available from the Social Security Administration.

Pros

- No contribution limits, but yearly contributions exceeding $15,000 may be taxable

Cons

- All asset transfers are irrevocable

- Beneficiaries can use assets however they choose — not just for higher education

- May impact eligibility for need-based aid

- Gains above $1,000 are taxable

Choosing the Right College Savings Account for Your Child

A 529 account was the most popular college savings plan among our survey respondents, and experts agree this is a solid choice. "I find that parents feel most comfortable with 529 plans," said Ann Brookes, an LL.M. tax attorney who addresses tax matters for families and small businesses. In an interview with BestColleges, Brookes explained there are many advantages to 529 plans:

"529 plans offer flexibility and control for parents or others creating them. While the money needs to be used for qualifying educational expenses, the allowable uses are many. They include tuition and fees; books, supplies, and equipment; computers, printers, software, and internet access; and, for students who are at least half time, room and board. In addition, the Tax Cuts and Jobs Act expanded qualifying education expenses to include up to $10,000 per year per beneficiary for K-12 public, private, or religious education."

To maximize savings, parents can also shop around for 529 plans across state lines since many do not have residency requirements. Of course, the main advantages of a 529 plan are the tax benefits. "Money deposited grows tax-free, and no tax is due when distributed if used for these purposes," Brookes said. She added that, "there is a 10% penalty for withdrawal of funds that is not for qualifying purposes." However, if a student receives a scholarship, a matching amount can be withdrawn from the account without penalty.

Unlike other savings plans, such as UTMA or UGMA accounts, 529 plans allow parents to control the funds and even change the beneficiaries. Brookes clarified what this means in practice: "The person creating the account can change the beneficiary without penalty or tax … [and] has control over the account and its funds until they are withdrawn. For families with several children, the tuition amounts may vary, and a 529 plan allows the flexibility to change the beneficiary, thereby accommodating this."

529 Plans vs. UTMA/UGMA Accounts

While 529 plans work for most needs, some parents may prefer UTMA or UGMA accounts. According to Brookes, the reason for using one of these accounts tends to be one of the following:

- UGMA/UTMA funds do not have to be spent on higher education, providing more flexibility if a student decides not to go to college

- UGMA/UTMA accounts can be invested in more ways than 529 plans, which have specified investment vehicles

Brookes had some helpful advice for parents deciding between savings strategies: "The choice of investment vehicle to save for college requires considering the pros and cons of each compared to what families want to accomplish and avoid. Sometimes, maintaining control over the account is paramount. This means parents can consider the needs of more than one child as they reach college age. Sometimes, maintaining control over the investments drives the decision. Other times, it is the ease of tax reporting that parents prefer. I often suggest that people consider what their goals are and what they want to avoid the most. Usually the netting of these will reveal the choice that fits their goals."

Tax Credits and Deductions for Education Expenses

Aside from paying no taxes on distributions (and some earnings) from college savings accounts, parents can benefit from separate tax credits and deductions related to higher education expenses. An education credit can help lower the cost of higher education by reducing the amount of taxes owed on your return. There are two types of federal education credits:

To qualify for these credits, you or your dependent must be enrolled at an eligible educational institution and paying for qualified education expenses. If you are eligible for both education credits in a given year, you can claim only one on your tax return.

Depending on your taxable income and the amount of the standard tax deduction for the year, you may or may not want to file for itemized deductions on your tax return. For expenses related to higher education, however, there are several deductions for which you might qualify, including deductions in the following categories:

- Student loan interest

- Qualified student loans

- Qualified education expenses

For more information on education credits, deductions, savings plans, and other educational assistance benefits, visit the Internal Revenue Service (IRS) website.

What About Parents Who Can't Contribute?

For many parents, contributing to a college savings fund may not be an option. A majority of parent-respondents in our survey (60%) said that they did not have a college fund set aside for their child. When asked about the greatest roadblocks to contributing to a college savings fund, the main reasons cited included the following:

- Low annual household income

- Difficulty balancing personal loans, mortgages, bills, and other life expenses

- Contributing to other savings accounts, such as retirement funds

While having cash in hand is the best way to pay for college, students and parents without significant resources can still take advantage of other financing options, including loans. Keep reading to learn about funding higher education without a college savings account.

Borrowing Money

There are a few ways to borrow money for college: A student can take out a loan in their own name, one or both parents can cosign on a student loan, or — though some financial experts warn against it — one or both parents can take out a loan on their child's behalf. Out of all our parent-respondents, 21% said they planned on borrowing money to help cover tuition; of those, 76% reported having no college savings fund put aside, while 24% were borrowing on top of having a college savings account.

If parents choose to take out a loan, they are liable for the full amount of the loan. This may be an unappealing option for parents whose children aren't fully committed to higher education. If you choose to cosign on a loan, you may be able to secure a lower interest rate for your child, but you are equally obligated to repay the loan. This means that if the child misses a payment, the lending agency will require payment from the parent cosigner(s).

Every type of loan comes with certain risks and benefits. In the next section, we detail the various loan types and the pros and cons of each.

Loans for Parents

Federal Direct Loan

A Federal Direct Loan, also known as a Parent PLUS Loan when applied to dependent undergraduate children, is a federal loan that parents can use to help pay for college. The total PLUS loan amount you can receive is the school's cost of attendance minus any other financial aid received. The school must be a participant of the Federal Direct Loan Program.

Pros

- Fixed interest rates

- You can borrow as much as you need, minus other financial aid

- Flexible repayment plans

- Eligible for some income-based repayment and loan forgiveness programs

Cons

- Parents with adverse credit history must meet additional qualifications

- Mandatory origination fee

Private Parent Loan

There are a variety of private parent loan options, such as the Sallie Mae Parent Loan. While these loans tend to offer lower interest rates compared to the Parent PLUS Loan, they also come with less flexible repayment options. For example, private loans are not eligible for income-based repayment plans.

Pros

- May offer lower interest rate compared to a Parent PLUS Loan

- There may be no origination fee

Cons

- Less flexible repayment terms

- Low interest rates may depend on good credit

- Hidden fees may substantially increase costs

Home Equity Loan

Parents with significant home equity (i.e., the difference between the value of a home and the balance on a mortgage) can secure a home equity loan to help finance their child's education. These loans may be cheaper than both private and federal lending options, but home equity — and thus the ability to recoup costs — is subject to market fluctuations.

Pros

- Lower fixed interest rates

- Longer repayment periods

Cons

- Your house is used as collateral, and home equity fluctuates

- Long application process

- Not tax deductible when used to pay for college

Which Type of Loan Is Best for Parents?

Among parents who took out loans or planned on taking out loans to help their kids pay for college, 63% said that they were using a federal parent loan, 24% said they were using a private student loan, and 2% said they were using a home equity loan. Federal loans are typically the first choice for parents and students, and this is advisable under most circumstances.

A Parent PLUS Loan, also known as a Federal Direct Loan, can be used at schools that participate in the Direct Loan Program. The following must be all be true of parents applying for a Parent Plus Loan:

- You must be the biological or adoptive parent (or in some cases, the stepparent) of a dependent undergraduate student enrolled at least half time at an eligible school;

- You must not have an adverse credit history, unless you meet certain additional requirements; and

- You and your child must meet the general eligibility requirements for federal student aid.

If a federal loan isn't possible, private loans may suit your needs. However, Rayner, financial aid director at UNG, recommends caution if you choose this option: "Private loans should be considered as a last resort for loans. In looking at private loans, you need to check not only the interest rate but how the interest rate is calculated. You also need to determine if there are any fees associated with the loan."

Home equity loans also come with risks, according to Rayner, who said, "I have seen situations where families have taken out home equity loans and something unexpected has happened to the family financial situation, which can put their total home investment at risk."

No matter what type of loan you choose, be sure to lay out expectations for helping to finance your child's education. "This is a partnership and a learning experience," Rayner said. "Sit down with your student and have an open, honest discussion about college, expenses, your grade expectations, and finances."

Should Parents Dip into Their Retirement Savings?

Parents who can't take out loans, or who need additional funds to help pay for their child's education, may consider dipping into their retirement savings. In fact, 9% of parents in our survey said they planned on dipping into a 401(k) or other retirement savings to help pay for their child's education, while 14% said they were considering it.

While needing the extra funds is understandable, it is usually inadvisable to withdraw from your retirement savings. The main reason, of course, is that these funds are needed for your retirement and are hard or impossible to recoup. There are also early withdrawal penalties and deferred taxes on funds withdrawn before retirement age.

The IRS states that for traditional IRAs, the penalty for withdrawing funds before age 59.5 (without a qualified reason) is normally a 10% early distribution tax on top of the deferred taxes you must pay on distributions, which are treated as ordinary income. However, early IRA withdrawals made for qualified education expenses are exempt from the 10% penalty. Roth IRA contributions, since they are already taxed, are never subject to additional taxes or penalties and can be used for higher education. Earnings from Roth IRAs, though, are taxed as ordinary income.

Unlike early withdrawals from IRAs, early withdrawals from 401(k) accounts are not exempt from a 10% penalty when used for higher education purposes. On top of the deferred taxes you must pay on an early 401(k) distribution, the 10% penalty makes such withdrawals particularly painful for parents. Moreover, to make such a withdrawal in the first place, the account holder must demonstrate financial hardship.

Helping Your Child With the FAFSA

Regardless of whether you intend to help your children financially with college, they should submit the Free Application for Federal Student Aid (FAFSA). The FAFSA determines a student's eligibility for any kind of federal financial aid, including federal loans, grants, scholarships, and work-study awards. Note that the FAFSA must be submitted for every year the student needs federal financial aid.

When completing the FAFSA, applicants must report their parents' income if they are dependent students. Federal aid depends on the assumption that a child and their family are responsible for paying for college, even if parents don't share in this assumption. A family's financial strength and a student's dependent status determine whether they qualify for federal student aid. Below are some rough guidelines for determining your dependent status, but be sure to consult the Student Federal Aid website for more detailed information.

- Dependent Student: To qualify for this status, a student must be under 24 and enrolled in an undergraduate program. Dependent students must also be unmarried and without dependents to whom they give substantial financial support. Veterans and active-duty members of the U.S. armed forces are not considered dependent students. Lastly, these students must not be or have been in foster care after age 13, emancipated minors, or currently homeless.

- Independent Student: Independent students must meet at least one of several conditions. They may simply be 24 or older or attending a graduate-level program, or they may be veterans or active-duty members of the U.S. armed forces. They could be married or have dependents whom they support financially, or they may have been in foster care after age 13, emancipated minors, or currently homeless.

To learn more about how to qualify for federal student aid, take a look at the BestColleges guide to understanding the FAFSA.

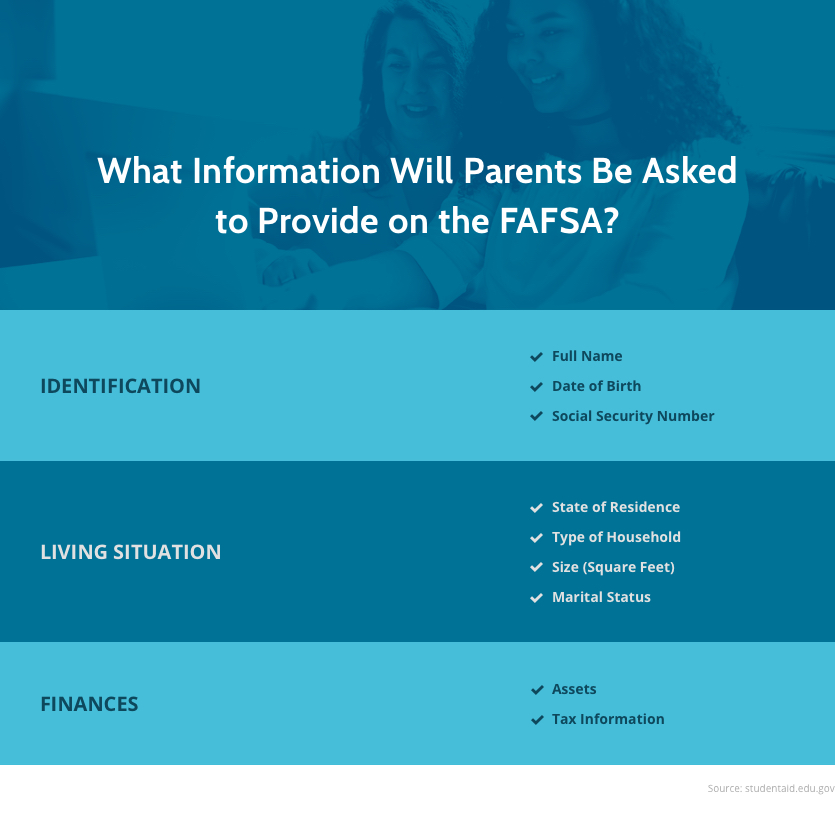

What Information Will Parents Be Asked to Provide on the FAFSA?

When filling out the FAFSA, applicants will be asked to report some basic information about their parents. This information includes their parents' identities (e.g., names, dates of birth, and Social Security numbers if applicable), living situations (e.g., states of residence, household size, and marital status), and financials (e.g., assets and tax information).

While parents are asked to provide financial information on the FAFSA, this does not imply an actual financial responsibility for a student's education. However, you may choose to help manage the multiple funding sources your child garners from the FAFSA, including loans and scholarships that begin and end at different times during the student's academic program. Of course, students themselves should be fully engaged in the financial aid process and should work with financial aid advisors at their school to ensure they're meeting certain deadlines and requirements.

If you are not a citizen of the United States and are unsure what information to provide on the FAFSA, take a look at the U.S. Department of Education's advice for noncitizen parents. Note that the FAFSA does not ask you about your citizenship status and that your status will not affect your child's ability to secure federal financial aid.

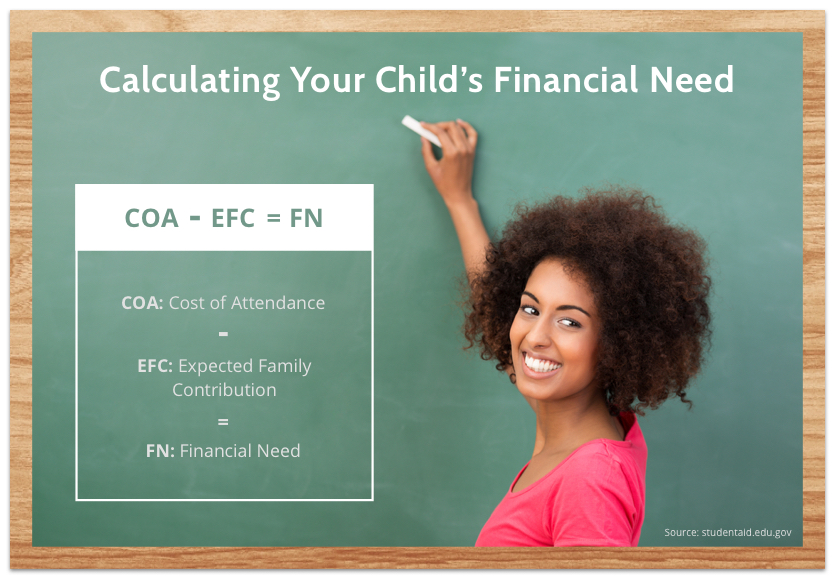

Calculating Your Child's Financial Need for College

Schools depend on the FAFSA to determine a student's financial need. The most crucial piece of information financial aid officers use from the FAFSA is the expected family contribution (EFC). The EFC is calculated using your family's taxed and untaxed income, assets, and benefits (such as Social Security or unemployment). By subtracting the EFC from the cost of attendance (COA), schools can determine your child's financial need.

Note that the EFC does not indicate how much money a student's parents are actually going to pay for college; it is used only to calculate a student's eligibility for need-based financial aid. It's also important to note that the COA includes costs such as tuition and fees, room and board, and books and supplies.

If in doubt, consult the Federal Student Aid website, which will guide you through the FAFSA process.

Editor's Note: This article contains general information and is not intended to be a substitute for professional advice. Please consult a professional advisor before making decisions about financial issues.