Financial Aid for LGBTQ+ College Students

- LGBTQ+ students can face institutional barriers in the financial aid process.

- Trans students may need to indicate their “sex assigned at birth” in the FAFSA.

- The FAFSA typically requires parent cooperation, but there are ways around this.

College is becoming costlier for everyone. However, LGBTQ+ students struggle more with financial challenges — like homelessness, poverty, unemployment, and barriers to healthcare — than their cisgender heterosexual (cishet) peers.

LGBTQ+ students can also face institutional barriers when paying for college and paying off student loans. Transgender and nonbinary students may need to complete the Free Application for Federal Student Aid (FAFSA) with information about their “sex assigned at birth” and not their gender identity.

Plus, they may lack support or cooperation from their families. A 2018 Human Rights Campaign survey reported that just 24% of LGBTQ+ youths could definitely

be themselves at home. Almost 70% heard their families negatively comment about LGBTQ+ people.

Some college students may not even have the means to get a loan if they are estranged from their family because of their identity and have no one to cosign for them. This makes their options more limited,

said Daniella Flores, queer financial blogger and founder of I Like to Dabble.

Here’s what LGBTQ+ students need to know about paying for college and budgeting for life beyond.

Paying for School: What LGBTQ+ Students Need to Know

Find some financial aid resources and tips for LGBTQ+ students below.

Applying for Grants as an LGBTQ+ Student

Schools, states, and the federal government award college grants to students to help cover education costs. Unlike scholarships, grants are typically based on financial need and not merit or academic performance. You may become eligible for grants by completing the FAFSA.

All students should complete the FAFSA — you could qualify for free money. But LGBTQ+ students may face challenges when it comes to completing the FAFSA.

If your “sex assigned at birth” doesn’t match your gender identity or expression…

The FAFSA application asks if you are “male” or “female.” In the 2021-2022 school year, the U.S. Department of Education (ED) stated that the easier response was to indicate your “sex assigned at birth” and not necessarily your gender.

Easier for whom, right?

The bottom line is your FAFSA records must match your Social Security Administration (SSA) record. So if you have already changed your SSA records to match your gender identity, then use that gender marker.

According to a White House statement, the ED plans to include a question about gender identity to study the financial aid barriers that certain student groups face.

If you were “assigned male” at birth…

The question that comes after the FAFSA’s sex-marker question asks you to register with the Selective Service System in the case of a draft.

In the past, any adult assigned male at birth needed to register, or they would be disqualified from financial aid. But as of July 2021, the ED no longer disqualifies students who do not register. In other words, you can now skip that question.

If you’re homeless…

You can complete the FAFSA as an independent student. That means that the government considers your income — not your parents’ — when determining how much aid you qualify for.

If you’re 24 or older, you can apply as an independent student with no problem.

If you’re younger than 24, someone must verify that you are homeless. That person can be an official liaison from your high school, a shelter or transitional housing director, or a youth center director.

If your parents refuse to financially support you…

In this case, if you’re 24 or older, you should apply for aid as an independent student.

If you’re under 24 and your parents refuse to support you, you must still enter their FAFSA information. If you have no contact with them or they refuse to give you information for the FAFSA, you must select the form option that says, I am unable to provide information about my parent(s).

Unfortunately, you may not qualify for federal grant money. But, you might qualify for a federal loan, which can have lower interest rates than private loans.

Student Loans

Student loans can be federal or private. Federal loans tend to have lower, fixed interest rates than private student loans.

Federal student loans can be subsidized, meaning the government pays interest on the loan while you’re a student. Or, they can be unsubsidized, where you owe interest even as a student. Typically, unsubsidized loans are for grad students or students who don’t have financial need.

Many adults who attended college racked up some debt for their education. The Center for LGBTQ Economic Advancement and Research found that LGBTQ+ adults had more education-related debt and borrowed more often than cishet adults.

There are pros and cons to student loans for everyone. But as with grants, LGBTQ+ students run into unique hurdles.

If you don’t have a parent who will cosign a loan…

Private lenders may require you to have a cosigner. Cosigners don’t need to be parents — or even relatives. According to Sallie Mae, a relative, guardian, spouse, or friend can cosign a private loan.

Unfortunately, if you cannot find a cosigner, this rules you out of some loans. The good news is that federal loans will not require you to have a cosigner. Neither will grants or scholarships.

If you plan to legally change your name or gender marker after taking out a loan…

You can change your name and gender marker on your Federal Student Aid ID. You can also contact a private lender to change your gender marker. However, you must start by changing your Social Security records. Then, work with your loan providers to ensure all of your information matches what’s on record at the SSA.

The National Center for Transgender Equality answers questions about changing your name and gender marker with the SSA. You can also find assistance through the Trans Legal Services Network.

LGBTQ+ Scholarships

Scholarships may be the best-kept secret among ways to pay for school. Many organizations offer scholarships for LGBTQ+ students, nonbinary and transgender student scholarships, and funds for children of LGBTQ+ parents. Some are available to all LGBTQ+ students. Others focus on specific regions or majors.

I wish I knew more about lesser-known scholarships and grants that I could’ve applied for through community organizations,

Flores said.

They recommend the Pride Foundation as a place for LGBTQ+ college students to scope out scholarships.

You can also search for scholarships on Campus Pride’s scholarship list.

Money Advice for LGBTQ+ Students

As it stands, the financial aid system isn’t designed to include the diversity of this world.

When you grow up in a society that only has financial systems built for heterosexual couples and doesn’t even have options on the paperwork that describe your life, that definitely deters you from wanting to even have financial agency,

Flores said.

However, LGBTQ+ students can take steps to secure their financial well-being.

Build an Emergency Fund

You can make smart money moves now to spend less in college and save for the future.

Build an emergency fund as soon as you can, and aim to fund it with six months’ worth of your living expenses,

Flores said. This will help you have a better buffer of money for when emergencies come up, transition expenses you didn’t see coming, healthcare expenses, and anything else you might need.

Recruit Help

Money trauma runs deep in the LGBTQ+ community,

Flores said. It is a complicated trauma when the society you grow up in only seeks to erase you.

Chances are, you’re not alone in experiencing financial stress. Talking about it with friends or at your campus LGBTQ+ center could be a place to start dismantling the stigma associated with LGBTQ+ money issues.

What’s Good for You Helps Other LGBTQ+ Folks, Too

Saving and educating yourself about finances can pay off, literally and figuratively.

When you save and invest in your early years, like your college years, you set yourself up for success throughout the rest of your life. But not only that, you set up your community for success, too,

Flores said. When younger LGBTQ+ folks see older folks take care of themselves like this, they will follow suit.

Financial Aid Resources for LGBTQ+ College Students

Here are some resources to help you find financial aid and set yourself up for financial success in college:

Point Foundation

Point Foundation is the largest scholarship-granting organization for LGBTQ+ students. They also provide mentorship, leadership development, training, and more.

Campus Pride

Campus Pride is a nonprofit organization working to create safer campus environments for LGBTQ+ college students. They offer a scholarship database to help you search for funding for your education.

Queer Money Podcast

Personal finance authors and experts David Auten and John Schneider aim to help the queer community become financially strong. They offer money tips for all areas of your life — not just education.

LGBTConnect

Part of being financially stable is having a steady stream of income. If you’re looking for an LGBTQ+-friendly employer, LGBTConnect is a job board that can help you with your search.

Human Rights Campaign

The Human Rights Campaign hosts another scholarship database on its website to help you search for funding. You can search by state, alphabetically, or by entering a keyword.

With Advice From:

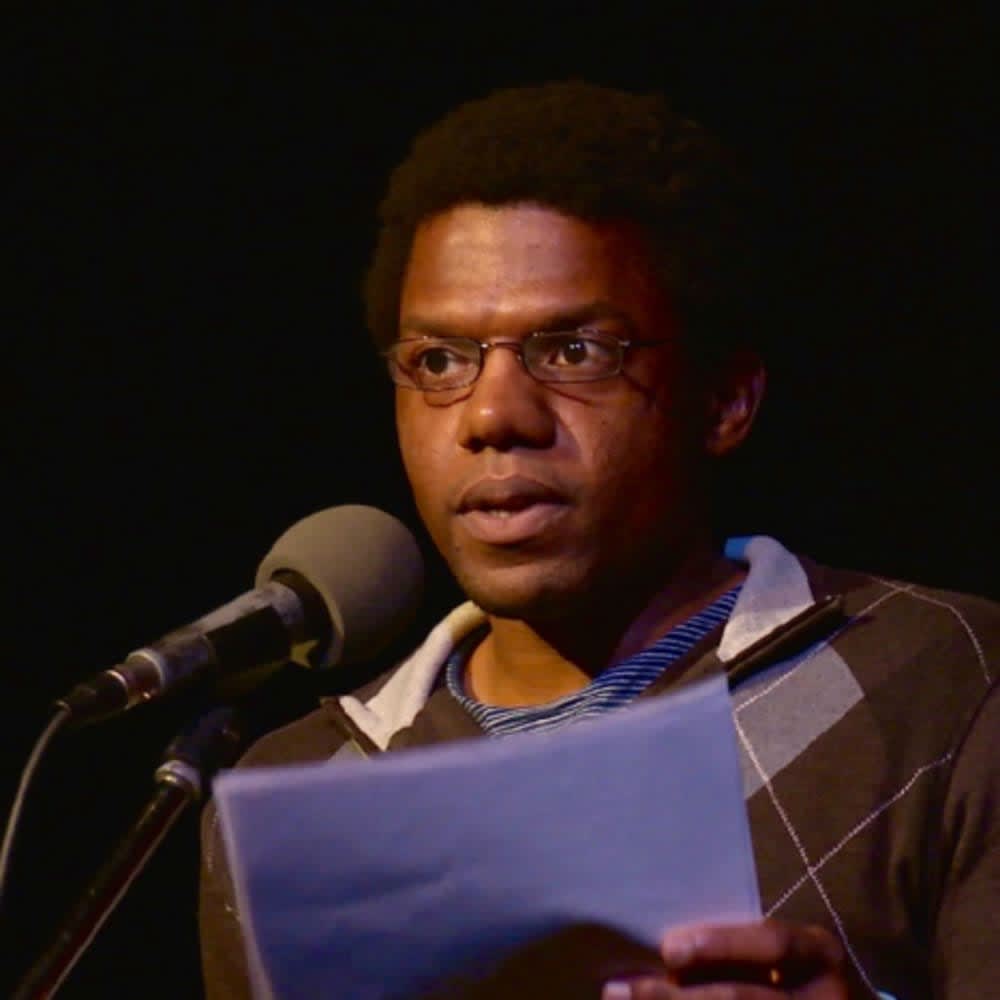

Daniella Flores is a nonbinary and queer Latine software engineer and founder of I Like to Dabble. They went from 0-12 income streams in four years, paid off over $40,000 of debt, and moved 2,100 miles cross-country with their wife, Alexandra, to live in their dream location. Now, they teach thousands of others how to start and grow their side hustles, work how they want, and get their money right. They’ve been featured on TIME, Investopedia, CNBC, MSN, SLATE, the Los Angeles Times, and more.

Explore More College Resources

College Experience Guide for LGBTQ+ Students

Explore common experiences and challenges of LGBTQ+ college students and learn how you can ensure your campus supports and affirms LGBTQ+ students.

by R.B. Brooks

Updated June 5, 2025